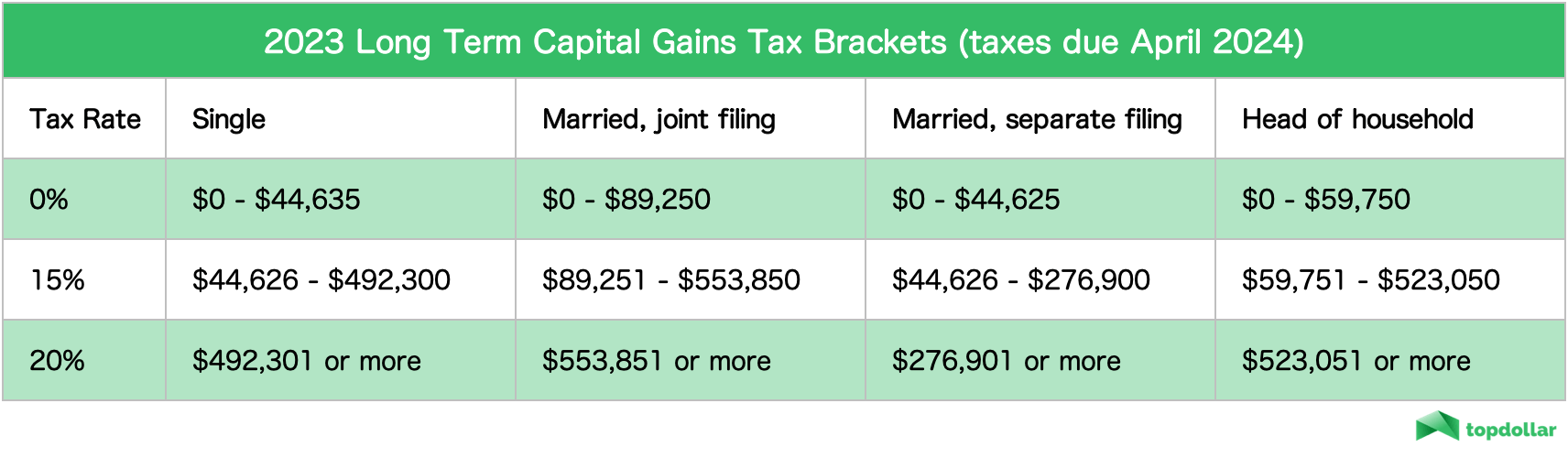

Capital Gains Tax Rate 2025 Home Sale - How much you owe depends on your annual taxable income. Capital gain tax on sale of property can be divided into two types: In 2025, capital gains on assets that are held over one year are taxed at the following brackets:

How much you owe depends on your annual taxable income. Capital gain tax on sale of property can be divided into two types:

Capital Gains Tax Calculator 2025 Uk Elisha Chelsea, If you sell an asset after holding it for less than a year, your capital. The rates are 0%, 15% or 20%, depending on your taxable.

2025 Long Term Capital Gains Tax Brackets Tatum Lauryn, The rate goes up to 15 percent on capital gains if you make between. Instead, a new ltcg tax rate of 12.5% will be applied to the capital gains on the sale of property, without considering the indexation benefit.

Capital Gains Tax 2025 Real Estate Elga Nickie, In 2025, capital gains on assets that are held over one year are taxed at the following brackets: You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held.

Capital Gain Tax Rates 2025 Myrta Tuesday, The irs taxes capital gains at the federal level and some states also tax capital gains. The government raised the tax rate for equity investments held for less than one year to 20% from 15% and for shares held for more than 12 months to 12.5 percent from 10 percent.

Capital Gains Tax Rate 2025 Home Sale. The long term capital gains tax (ltcg) on property sales has been reduced from 20% to 12.5%, but the budget fine print revealed that the indexation benefit on real estate has been removed and will result in higher tax outflows for sellers. What are the capital gains tax rates for 2025 vs.

Capital Gains Tax 2025 Real Estate Calculator Vikky Jerrilyn, Here is an example from. If you sell an asset after holding it for less than a year, your capital.

Capital Gains Rate 2025 Table Image to u, Capital gain tax on sale of property can be divided into two types: Gains on the sale of personal or investment property held for more than one year are taxed at favorable capital gains rates of 0%, 15%, or 20%, plus a 3.8%.

In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married.

Capital Gains Tax Rate 2025 Home Sale Essa Ofella, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how. You’ll pay a tax rate of 0%, 15% or 20% on gains from the sale of most assets or investments held.

Capital Gains Tax Rate 2025 Overview and Calculation, The long term capital gains tax (ltcg) on property sales has been reduced from 20% to 12.5%, but the budget fine print revealed that the indexation benefit on real estate has been removed and will result in higher tax outflows for sellers. Capital gain tax on sale of property can be divided into two types:

Capital Gains Tax Rate 2025 Real Estate Ca Adina Meriel, The profit you make when you sell your stock (and other similar assets, like real estate) is equal to your capital gain on the sale. Single filers can qualify for the.

You will owe capital gains taxes on the net profit from the sale, but you will also owe gains on the cumulative depreciation benefits you have received while you.

In simple terms, this capital gains tax exclusion enables homeowners who meet specific requirements to exclude up to $250,000 (or up to $500,000 for married.

Capital Gains Tax 2025 Real Estate Calculator Merl Stormy, Capital gains tax is a levy imposed by the irs on the profits made from selling an investment or asset, including real estate. On the positive side, for the benefit of the lower.